As the UAE accelerates its digital transformation journey, e-invoicing stands out as a cornerstone initiative aimed at enhancing tax compliance, operational efficiency, and transparency across business ecosystems. The mandatory e-invoicing mandate is set to begin in the second quarter of 2026.

At the heart of this transformation is a robust, technologically advanced infrastructure being designed to serve the needs of today while anticipating the demands of tomorrow.

Below, we explore eight key technological drivers that are shaping the UAE’s e-invoicing framework.

1. Peppol-Based Five-Corner Model: A Foundation for Secure Interoperability

The UAE’s adoption of the internationally recognized Peppol network, specifically the five-corner model, aims to ensure a structured and secure invoice exchange between suppliers, buyers, accredited service providers, and tax authorities.1 This globally proven framework guarantees interoperability, standardization, and end-to-end visibility, paving the way for seamless integration across all stakeholders.

2. Decentralized Continuous Transaction Control (DCTCE): Real-Time at Scale

Unlike traditional centralized models, the UAE’s decentralized CTC approach will enable near real-time validation and reporting of invoice data.2 By leveraging distributed technologies, the system will ensure greater scalability, resilience, and reduced bottlenecks—empowering businesses to operate at the speed of trust.

3. Accredited Service Providers (ASPs): The Trusted Digital Intermediaries

Businesses are required to interact with UAE-accredited service providers who act as the bridge between enterprise systems and regulatory platforms. These ASPs will validate, transform, and securely transmit invoice data in the required Peppol-compliant XML format, ensuring full adherence to data standards and regulatory mandates.

4. Standardized Data Formats: Enabling Structured Intelligence

The use of machine-readable formats such as XML aligned with the Peppol PINT specification will ensure consistency, accuracy, and seamless integration with internal systems and external platforms. The AE PINT Data Dictionary will provide a unified standard for invoice attributes, simplifying compliance and reducing reconciliation errors.3

5. Real-Time Validation and Reporting: Compliance with Confidence

With near-instantaneous validation and reporting capabilities, businesses will benefit from reduced errors, faster invoice processing, and improved compliance monitoring. Data will flow directly to the Federal Tax Authority (FTA) and Ministry of Finance (MoF), closing the loop between issuance and reporting.

6. Electronic Signatures: Securing Every Transaction

Mandatory electronic signatures will add a critical layer of authenticity and integrity to every invoice. This will ensure a tamper-proof audit trail, reinforce data security, and build confidence across the invoicing lifecycle.

7. Automation and ERP Integration: Streamlining Operations

The system will support seamless integration with ERP and accounting platforms through standardized APIs, enabling full automation of invoice creation, validation, exchange, and storage. The result: lower operational costs, fewer manual errors, and accelerated cycle times.

8. Future-Ready by Design: Scalability and Cross-Border Potential

Built on globally recognized standards and a decentralized infrastructure, the UAE’s e-invoicing model is engineered for future scalability. From potential B2C applications to cross-border interoperability, the framework positions the UAE as a digital frontrunner on the global tax compliance stage.

With a strong foundation in global best practices and a clear vision for innovation, the UAE’s e-invoicing initiative sets a benchmark for digital tax ecosystems worldwide. By enabling agility, ensuring compliance, and fostering trust, the e-invoicing mandate is not just transforming how invoices are exchanged—but how businesses operate in an increasingly connected economy.

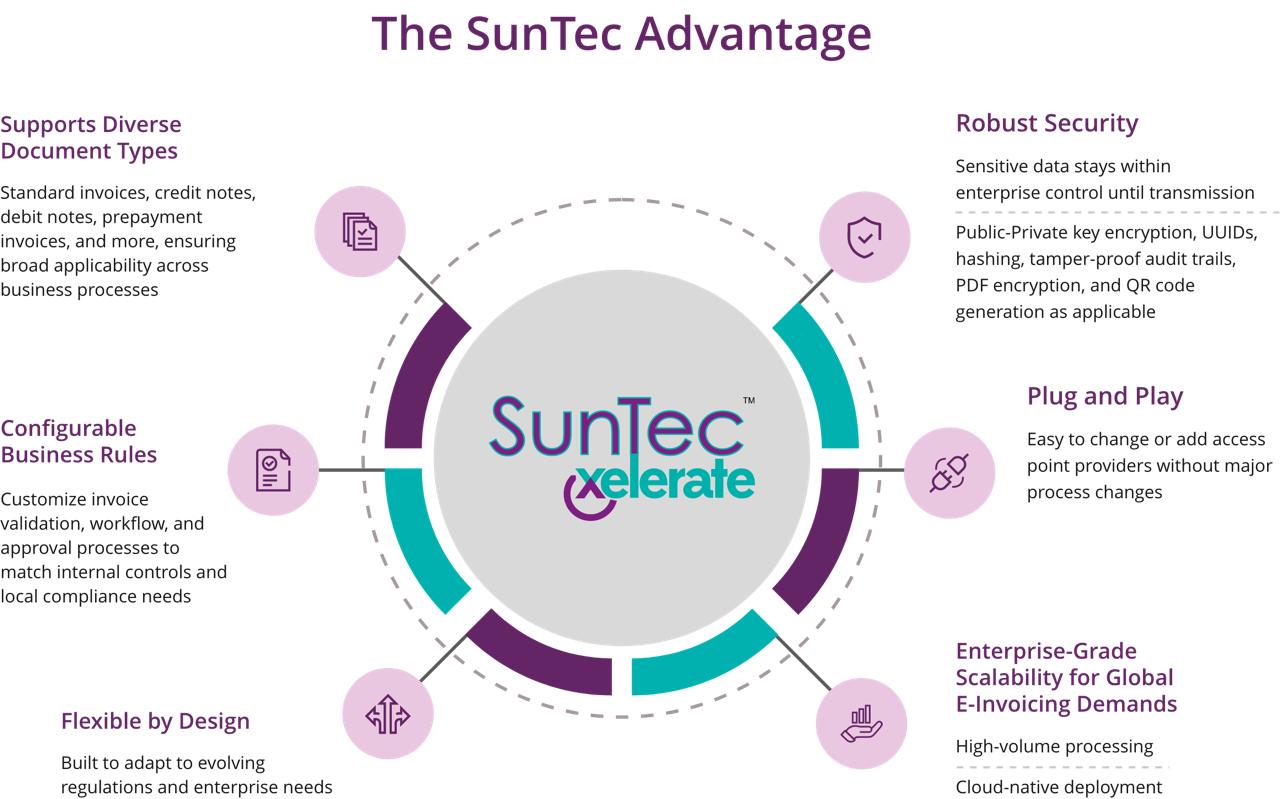

At the forefront of this transformation, SunTec’s E-Invoicing Solution empowers enterprises to confidently navigate complex regulatory landscapes. Built on over 30 years of global expertise in pricing, billing, and revenue management, and trusted by over 50 organizations worldwide, the platform offers a future-ready, flexible architecture that adapts effortlessly to evolving mandates, whether it’s Peppol’s five-corner model, decentralized CTC frameworks, or hybrid systems. With seamless integration with enterprise systems and minimal IT disruption, SunTec enables businesses to simplify compliance, accelerate digital transformation, and maintain control across every stage of the e-invoicing lifecycle.