Do you remember what it was like to get a loan from a traditional banking platform? It involved multiple steps and channels – one for credit checks, another for documentation, and yet another for final approval. It was time consuming, involved disparate systems, multiple steps, and was a frustrating experience. But what if you could access a loan seamlessly from a car buying app or a real estate portal without even having to leave that platform? What if finance was embedded into different non-banking services and products that you engage with, ensuring a frictionless, seamless experience?

Thanks to technology, embedded finance is now a reality. Customers can be on an e-commerce site, a ride hailing app, a subscription service, or a coffee chain’s app, and they can easily avail of financial products without having to leave the platform they are on. Embedded finance’s true value lies in its ability to make the customer journey frictionless by making financial services almost invisible to the end user. The goal is to make financial services seamless, and fully integrated into the customer’s primary activity, whether it’s making a purchase, booking a ride, or managing a subscription. This transformation is powered by technology. It marks a fundamental shift in how financial services are delivered and consumed. In this article we will dive into the world of embedded finance and the promise it holds for the future of the financial sector.

The Emergence of Embedded Finance

Embedded finance marks a distinct move away from the traditional banking distribution channels where the banks controlled the customer journey. In an embedded finance scenario, the customer is at the heart of a larger ecosystem that also includes banks. Scalability and decentralization are hallmarks of the embedded finance model as banks are no longer solely responsible for orchestrating every aspect of the customer experience. The rise of embedded banking can be traced back to the emergence of open banking standards. Open banking provided the foundation of the API economy that enabled embedded banking. It democratized access to financial services, allowing more players to participate in the financial ecosystem. This broader participation has made embedded banking viable and scalable, as it encourages competition and innovation from various third-party providers. An EY survey suggests that over 94% global technology financial leaders believe that a financial product’s success hinges on its ability to meet customers’ real-time needs.1

Exploring Real-World Applications of Embedded Finance

Embedded finance works across three common use cases – spending, subscription management, and borrowing.

- Spending: Before the emergence of embedded banking, a buyer on the check-out page of an e-commerce site was typically re-directed to a third-party financial institution’s platform to complete their payment. This involved multiple steps – entering payment details, verifying the details with an OTP, and then being directed back to the e-commerce site after the transaction was processed for purchase verification. Shoppers found this experience frustrating leading to a high risk of cart abandonment. With embedded finance, the payment functionality is directly integrated with the e-commerce platform allowing shoppers to pay without leaving the platform. The financial institution’s role—whether it’s processing the payment, authorizing the transaction, or settling the funds—is embedded behind the scenes. This ensures a convenient and transparent process for customers. And the business benefits from happier customers, fewer cart abandonments, and better sales.

- Subscription Management: Subscriptions are a central revenue model for businesses, platforms and streaming services. Subscription-based business models depend on recurring fees, and businesses require watertight subscription management processes to ensure efficient billing and seamless operations. Traditionally, customers set a mandate with their financial service providers, which was then communicated to the subscription service. This was a disjointed process with the possibility of payment issues due to incorrect mandate management. It resulted in a fragmented experience for customers where they had to engage with their banks on one end and service providers on the other. Embedded finance models integrate financial processes into the platform, which handles everything from mandate, payment collection, and billing cycles. But for this to work effectively the bank needs robust revenue and subscription management platforms to manage the complexities of different billing cycles, proration, early cancellations, and ensuring accurate revenue management.

- Borrowing: Embedded finance models empower customers to avail of loans from whichever platform they are on at the time of checkout. This is particularly conducive for Buy Now Pay Later (BNPL) models. The system can automatically pull data such as transaction history and credit score to evaluate the customer’s creditworthiness. Based on credit evaluation, the system determines the customer’s risk profile, decides on their eligibility, and presents loan options. Once the transaction is completed the customer can manage their payment plans directly on the retailer’s platform without engaging with the bank. This opens opportunities for targeted offers, personalized financing options, and even allows the business to analyze payment schedules and forecast revenues. But once again, banks need a robust revenue management system to manage the embedded loan process as well as billing, invoicing, and transparent revenue sharing practices.

Changing Revenue Models

As embedded finance continues to gain traction, revenue models are witnessing a distinct transformation. The traditional on-premise licensing models evolved into SaaS subscription-based models, followed by a combination of subscription and metered pricing models. Now banks and financial institutions are exploring specific verticals, moving away from traditional models of partnering, reselling, and bundling third-party products. There is a shift to user-centric marketplaces where the bank is one of the key players.

The Technology Foundation for Embedded Finance

Embedded finance models necessitate robust technology platforms that can manage the complexities of the various processes associated with billing, invoicing, and most importantly, revenue sharing. Revenue sharing agreements can be complex with several conditions, and the technology foundation must be robust, flexible, and scalable enough to ensure error-free fee distribution and revenue sharing.

For example, a leading multinational bank partnered with an ERP solution provider for corporate customers to integrate financial services, such as working capital financing, payments, and collections, into the ERP offerings. Revenue was generated when customers availed of financial services through the ERP provider. The distribution of the revenue was based on specific conditions, such as the volume of business conducted on the ERP system. The revenue-sharing agreement included thresholds and tiered structures. If the total business sourced by the ERP system in each period was below a certain threshold, all the revenue had to go to the bank. But if it exceeded this threshold, it was to be shared between the two parties according to a pre-agreed ratio, which could vary based on the amount of business. The revenue was to be further divided within the bank amongst different teams involved in the process – part of the revenue could go to the transaction banking team, part to the liabilities business, and part to other relevant departments, depending on their contributions to the service. Managing this complex revenue sharing arrangement would be impossible without a robust, scalable, technology foundation. The bank deployed our cloud-native, microservices-based revenue management platform over their legacy core to ensure that the process was seamless, accurate, and efficient.

SunTec Xelerate – Powering Embedded Finance

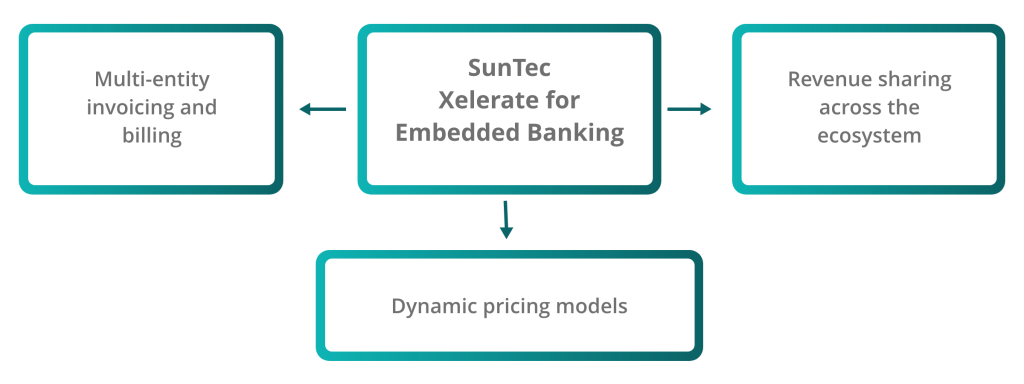

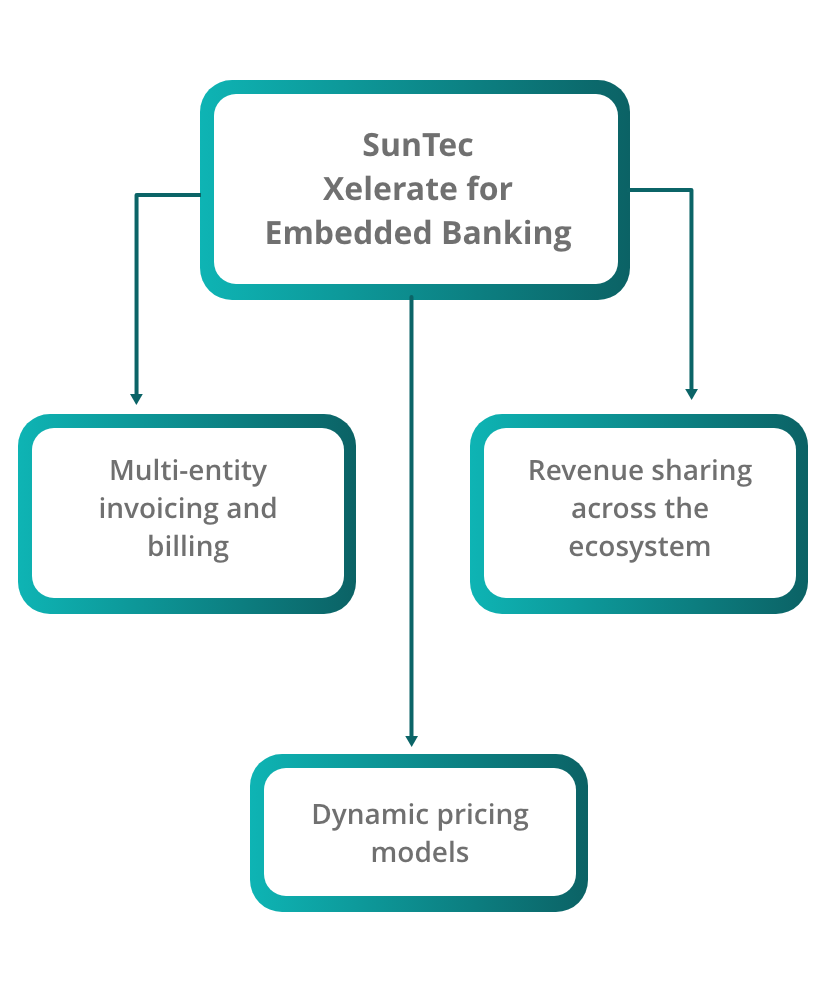

Embedded finance’s success hinges on the seamless integration of various financial services into non-banking platforms, requiring sophisticated and flexible models that can handle the complexities of revenue management and assurance. SunTec Xelerate is a powerful cloud-native, microservices based, API-first revenue management system that can help banks manage their embedded banking ecosystem with robust revenue management, dynamic pricing, and efficient billing processes.

Revenue Sharing:

- Manage legal hierarchies, negotiations, and build contracts across hierarchies: Multiple financial and non-financial partners come together to form an embedded finance ecosystem. Each entity has its own legal structure, systems, and requirements that must be addressed in the negotiations, and contract building. SunTec Xelerate can seamlessly manage multiple legal hierarchies to build and manage comprehensive negotiations and contracts.

- Manage complex revenue sharing across the embedded finance ecosystem: In embedded finance, financial institutions often engage with a diverse range of partners, including fintech companies, retailers, service providers, and more. Each of these entities operates within its own legal and relational hierarchy, necessitating a high degree of flexibility in how contracts and revenue-sharing agreements are managed. SunTec Xelerate provides the tools to navigate these complexities by enabling institutions to structure and manage legal and relational hierarchies efficiently. This capability is critical for maintaining harmonious and profitable partnerships within the embedded finance ecosystem.

- Manage product, services, offers, campaigns, and price lists: The embedded finance model thrives on the seamless integration of various financial products and services into non-financial platforms. Managing these offerings—along with associated campaigns, price lists, and value exchanges—requires a robust and centralized solution that can handle the dynamic nature of the marketplace. SunTec Xelerate ensures that all value exchanges within the ecosystem are efficiently tracked and monetized, allowing institutions to maximize revenue opportunities while delivering personalized and relevant offers to customers.

Dynamic Pricing Flexibility

A cookie cutter approach to pricing no longer works in a world where customers expect hyper-personalized offerings. An embedded finance model can only work if the bank can offer dynamic pricing models that are adjusted based on factors like market conditions, customer behavior, customer journey, transaction volumes, and the partners involved. Suntec Xelerate supports multiple levels of pricing hierarchy and resolution. And it enables multiple dimensions of standardization and personalization of price points.

Efficient Multi-Entity Invoicing and Billing Processes

Accurate and timely invoices and billing is crucial for any financial relationship. And in the embedded finance ecosystem, each stakeholder in the value chain, including banks, fintechs, integrators, and retailers need accurate and timely billing information. This calls for seamless integration and coordination between all the different entities involved. SunTec Xelerate can flexibly define invoice hierarchies and multiple entity invoicing requirements. It can not only consolidate revenue and present invoices but also allow contextual rebates, discounts, capping on fees, and penalties wherever applicable. It also supports critical post invoicing issues such as disputes and write offs.

Conclusion

The business of banking is undergoing a fundamental transformation. From being an inflexible entity that dictated terms of engagement with customers, banks are now becoming contextual and frictionless. Today, it is a living bank that tailors its services and products to the specific needs of users and offers a hyper-personalized integrated experience. While the open banking and API economy provide a sound foundation for embedded finance and living banks, it is also important to have the right technology foundation in place that can manage the embedded finance process and ensure error-free revenue sharing within the ecosystem.