Products

- Products

- Products Overview – Accelerate innovation and customer centricity with SunTec.

- Benefits and Loyalty Management – Improve your share of wallet – engage with your customers across product lines with targeted and differentiated loyalty programs.

- Deal Management – Automate end-to-end deal management and provide flexibility to create customer specific deals.

- Dynamic Offer Management – Grow and enrich your customer relationships by quickly launching highly personalized and contextual offers.

- Ecosystem Management and Monetization – Embrace the open economy – adopt new business models and increase revenue sources.

- Enterprise Billing and Statements Management – Increase customer trust and transparency through accurate billing and prevent revenue leakage.

- Enterprise Indirect Taxation Management – Comply with all indirect taxation requirements through a dynamic enterprise taxation solution.

- Enterprise Product Management – Establish customer choice at the heart of your enterprise and enable right selling.

- Relationship-based Pricing Management – Bring pricing to the forefront of your customer engagement strategy by creating an enterprise pricing master.

- Custom right

Discover how pricing plays a crucial role when formulating strategies to deliver superior customer experience.

- Products Overview – Accelerate innovation and customer centricity with SunTec.

- Industries

- Industries Overview – Count on our vertical focused, award-winning products and solutions.

- Financial Services – Get the agility and scalability to digitally transform your offerings and reap benefits of product innovation and real-time analytics.

- Insurance – Identify and mitigate revenue leakages, rationalize products, connect with external partner ecosystems and present contextual offers.

- Telecom – Enhance your customer experience management capabilities with the right level of process automation, analytics and product innovation.

- Travel – Take your business to the next level and create multiple monetization opportunities on a single platform.

- Custom right

Getting Tech Right: Selecting the Right Software Products to Fulfil the Digital Demands of Banking How must banks gear up for a digital future? Be an early mover and get the Finextra impact study:

- Industries Overview – Count on our vertical focused, award-winning products and solutions.

- Solutions

- Solutions Overview – Build relationships, enhance efficiency, and ensure compliance.

- Custom right

- Personalization Solution for Banking – Tailor your offer to each customer’s specific needs.

- Product Rationalization – Reduce complexity, enable agility, and offer a spectrum of choices to your customers.

- Credit Card Solution – Personalize your credit cards program to attract and retain customers.

- VAT – Comply with Value Added Tax (VAT) in the GCC.

- Negative Interest Management – Acquire the capabilities required to rapidly roll out negative interests and evolve with the policy.

- Banking-as-a-Service – Deliver lifecycle experiences through the ecosystem and not with mere products and services.

- Invoicing Solutions for Swedish Banks – Meet your invoicing needs seamlessly and automate end-to-end billing process.

- Account Analysis Solution – Deliver accurate and transparent account analysis statements

- ESG Solution – Accelerate Your Bank’s Progress on its ESG Journey with the SunTec ESG Solution

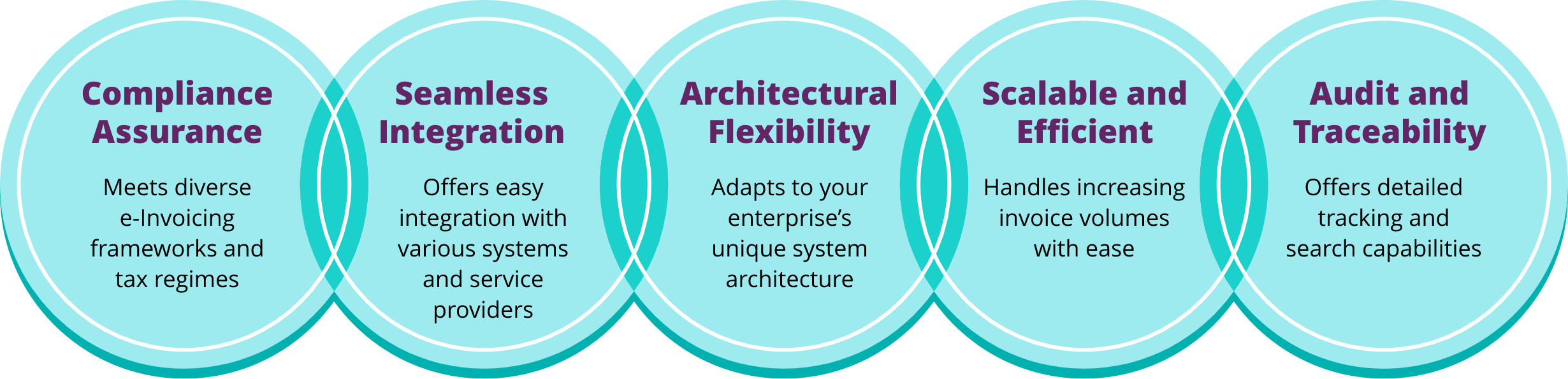

- e-Invoicing Solution for KSA – Increase transactional efficiency and ensure complete digital invoicing while also staying compliant.

- Personalization Solution for Banking – Tailor your offer to each customer’s specific needs.

- Product Rationalization – Reduce complexity, enable agility, and offer a spectrum of choices to your customers.

- Credit Card Solution – Personalize your credit cards program to attract and retain customers.

- VAT – Comply with Value Added Tax (VAT) in the GCC.

- Negative Interest Management – Acquire the capabilities required to rapidly roll out negative interests and evolve with the policy.

- SunTec Banking-as-a-Service – Deliver lifecycle experiences through the ecosystem and not with mere products and services.

- Invoicing Solutions for Swedish Banks – Meet your invoicing needs seamlessly and automate end-to-end billing process.

- Account Analysis Solution – Deliver accurate and transparent account analysis statements

- e-Invoicing Solution for KSA – Increase transactional efficiency and ensure complete digital invoicing while also staying compliant.

- ESG Solution – Accelerate Your Bank’s Progress on its ESG Journey with the SunTec ESG Solution

- Custom right

- Solutions Overview – Build relationships, enhance efficiency, and ensure compliance.

- Platforms

- Platforms Overview – Built for customer-centricity, efficiency, and security.

- Custom right

Celent's Take on SunTec Xelerate: Helping Banks Adopt Customer-Centric Product Strategies

- Insights

- All Resources – Read up on the latest market developments and expert insights.

- Articles – Know the multiple facets of key industry topics through our articles.

- Blogs – Explore our latest blogs.

- Case Studies – Discover how our clients across verticals benefited with SunTec.

- Data Sheets – We have a lot to say, unravel our product offerings!

- eBooks – Get a comprehensive look into the top industry trends.

- Podcasts – Listen to our latest podcast episodes on banking, telecom and more.

- Point of View – Here’s our take on the industry’s pivotal topics!

- Reports – Get insights on topics that are transforming enterprises.

- Use Cases – Discover use cases that match your organization’s business needs

- Videos – Watch our videos to know how our products and solutions are helping organizations adopt a customer-first strategy.

- Webinars – Get the most valuable insights from industry pioneers and optimize your business.

- Whitepapers – Get the newest thought leadership content from our experts.

- Custom right

Six-in-10 banks cite real-time account balance information as the most important service that they offer to corporate customers. Find out more on how to reinvent account analysis.

- All Resources – Read up on the latest market developments and expert insights.

- About

- Company – SunTec offers a portfolio of industry-agnostic products and solutions that empower organizations like yours to orchestrate seamless customer experiences, deliver exponential value, and much more!

- Contact Us – We’d love to hear from you!

- Career – Become a part of a global community of passionate professionals! Come, join us and find the job you love.

- CSR at SunTec – Know more about our CSR initiatives as we work towards a better tomorrow.

- Events – Know more about the top industry events we host and are a part of!

- News Room – Explore our latest media coverage and press releases.

- HR Initiative – Get a glimpse of the people who drive our growth!

- Partner – Join us to unlock the true potential of our products and solutions for an unparalleled and engaging proposition.

- Custom right

What Drives the People at SunTec? Explore inspiring testimonials and employee experiences, one story at a time

- Company – SunTec offers a portfolio of industry-agnostic products and solutions that empower organizations like yours to orchestrate seamless customer experiences, deliver exponential value, and much more!

Industries

Solutions

APAC

EMEA

Nordic

Latam

North Americas

Insights