After the disruption caused by the pandemic, the world is now facing new challenges in the form of escalating geopolitical tension, and an economic slowdown. Countries across the world are focusing their efforts on reviving their economies, sustaining livelihoods, and restoring national prosperity.

Taxes and fees are important ways for the Government to generate public revenue and increase investment in human capital, infrastructure, and the provision of services for citizens and businesses. But manually computed paper invoices are prone to human errors and even fraud, resulting in tax loss for Governments. Thanks to the global push for accelerated digital transformation, countries now have the technology foundation they need for transitioning to e-invoicing systems.

Accurate Tax Reporting and Preventing the Development of Shadow Economies

A tax-to-GDP ratio is an estimate of a nation’s tax revenue, relative to the size of its economy as measured by gross domestic product (GDP). The ratio provides a look at a country’s tax revenue because it reveals potential taxation relative to the economy. Countries collecting less than 15% of GDP in taxes must increase their revenue collection to meet basic needs of citizens and businesses.[i]

But the challenge is that tax compliance is high only when third parties are responsible for tax-related reporting (e.g., employer reporting wages distributed, real-estate/property registration office reporting buy and sale of residential and commercial properties). Unfortunately, when it comes to self-reporting, compliance is noted to be low.

Further, the biggest challenge the tax authorities have is the lack of knowledge or information of the true tax base. This then becomes a fertile ground for a shadow economy and informal business transactions, and results in corruption, and lack of consumer protection.

The Emergence of e-Invoicing Mandates

To address the challenge posed by under-reporting of taxes, and the emergence of a shadow economy, some countries are encouraging and mandating use of “Electronic Fiscal Devices” (EFDs). But most others are mandating e-invoicing.

e-Invoicing is a digital method for exchanging and processing invoices between buyers and sellers. Its integrated electronic format aims to regulate the invoicing and taxation process in a bid to prevent a shadow economy from forming. An increasing number of countries are making the shift to e-invoicing with noticeably positive results.

Critical Considerations for e-Invoicing Technology Platforms

In the initial days of e-invoicing, the buyer and seller agreed on matters such as integration, and worked on systems specific to their needs that were usually managed by the buyer. But now governments are mandating e-invoicing, and they are also defining standards and regulations that ensure easy interoperability.

Understandably, meeting e-invoicing requirements and requires a powerful, and agile technology foundation. This platform must not just be able to meet regulatory and business objectives, but also effectively address the challenges of enterprise-wide change management. Businesses also need to ensure the end customer is not inconvenienced during or after the transition. The right technology platform is a critical investment, but the question is, how do organizations choose the best solution from the plethora of options? Here are the eight critical capabilities that must be considered when implementing e-invoicing solutions:

- Highly reliable e-invoice generation capability both in batch and real time: Most businesses running batch data will move to real time soon. The e-invoicing system must have both batch and real-time e-invoicing capabilities. Even those businesses that don’t see a need for real-time e-invoicing must future-proof themselves. Businesses that have traditional batch processing/high-volume processing must ensure that the e-invoicing system is scalable to meet high-volume SLAs.

- Support legacy forms of data exchange: e-Invoicing applications must integrate and fit within a complex system landscape in large enterprises. This will include systems based on different technologies of different generations, and e-invoicing applications must offer flexible data exchange capabilities.

- Availability of standard out-of-box libraries of various codes: This includes Tax Codes, Country Codes, Currency Codes, and so on. This must be self-maintained and not dependent on the solution vendor.

- Robust and comprehensive integration capabilities with internal systems: Out-of-box system integration interfaces must address compliance needs, business, and operational needs.

- Robust APIs at the system core: This is non-negotiable as it is needed to be able to contextualize the e-invoicing application to business needs and reduce dependency on the application provider.

- Ready integration with regulator portals and ability to work in multiple modes (pre-authorization, post-authorization, and so on): Different kinds of businesses require different modes of integration. For example, in some countries, post-authorization of invoices is the prevalent mode for high-volume B2C services, but pre-authorization is used for low-volume B2B, G2B, and B2G invoices.

- Ability to generate invoice PDFs to ensure configurability while providing security controls: Ideally, e-invoicing must ensure zero-touch interaction between the buyer and seller. But there are likely to be multiple situations, especially in B2C engagements, where invoice PDFs are required. These invoice PDFs must have standard security measures implemented to reduce vulnerabilities.

- Regeneration and re-dispatch of invoices through different channels: Regeneration and re-dispatch of invoices could be done for many reasons such as error correction, lost communications, and more. The e-invoicing solution must make it operationally easy to reprocess and re-dispatch the invoices.

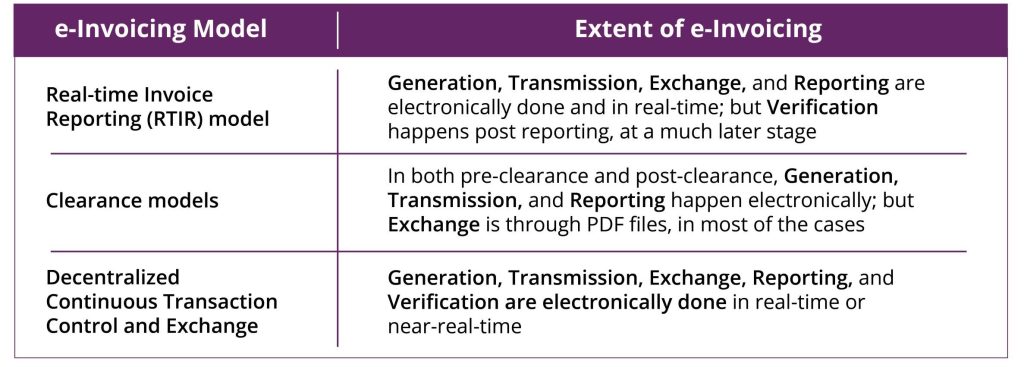

While interoperability is a basic common aspect, end-to-end digitalization – electronically generating, transmitting, verifying, exchanging, and archiving the invoices – varies across these models. A glimpse of this is shown below:

Finally, accurate tax reporting is a crucial element of ensuring economic resurgence and stability that will allow nations to focus on citizen welfare. The prevention and eradication of shadow economies is a top concern for most governments across the world and e-invoicing is a key tool in their arsenal for this task. As more countries make the transition to e-invoicing models, it is critical for organizations to put in place the right systems and processes to ensure seamless compliance.

To learn how SunTec can help you meet your e-invoicing requirements, write to us at contactus@suntecgroup.com.